When it comes to economic miracles, no other country has pulled off quite as many as China - and even its leaders are sceptical.

There has been a lot of controversy over the years about the reliability of China's official figures. Photo: Unsplash / Alejandro Luengo

China's most recent miracle was its breakneck recovery from Covid-19 (without falling into recession), while most other countries are struggling to even return to "normal".

The Middle Kingdom has also come a long way since its days of extreme poverty, with the five-year period from 1958, known as the Great Leap Forward, being a particularly dark time.

Tens of millions of people died under Chairman Mao Zedong's signature policy - which involved the state controlling most aspects of people's lives and inefficient economic management.

It's estimated that 15 million to 55 million people died from widespread starvation and overwork (as well as torture and executions).

However, China's fortunes became a lot rosier after Mao died in 1976. His successor Deng Xiaoping took over after a couple of years and made some very radical policy changes.

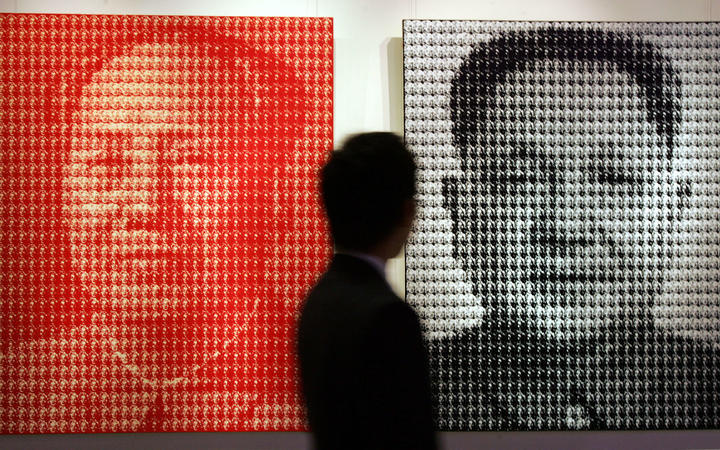

An artwork depicting Chairman Mao Zedong and successor Deng Xiaoping. Photo: AFP

'Made in China' boom

Under Deng, China stopped being a 'command economy' (where micro-management was the norm), and transformed into the world's factory - making a mint selling cheap 'Made in China' goods across the globe.

"A lot of China's economic success from late 1970s involved the Chinese government getting out of the road," said Professor James Laurenceson, an Australian-China relations expert at the University of Technology Sydney.

"That's when they let the people unleash their entrepreneurial skills in free markets, rather than being forced to sell to the government at artificially reduced prices."

China's relatively low wages also gave it a strong competitive advantage, and this manufacturing boom turned it into the world's largest exporter by 2008.

As the country got richer, so did the living standards of more than 800 million citizens.

Many have called it the greatest poverty reduction program ever (decades after enduring the worst famine in history).

READ MORE

- NZ risks giving China 'coercive power' over economy - US General

- New Zealand won't accept 'master-servant relationship' with China to derive economic benefits

- Nanaia Mahuta asks for advice about 'processes, considerations' of determining genocide, Labour to consider ACT's proposed China motion next week

- Jacinda Ardern hits out at dramatic 60 Minutes Australia New Zealand-China relationship commercial

Since China opened up in 1978, its economy has grown exponentially - by almost 10 per cent each year, on average.

It's now the world's second largest economy, worth about $US14.7 trillion, according to World Bank data.

To put that figure in context, it's smaller than the United States' economy ($US20.9t).

China's Premier has his doubts

There has been a lot of controversy over the years about the reliability of China's official figures. Many people (outside of the National Bureau of Statistics) will tell you to these numbers should be taken with a grain of salt.

They confessed to have "faked economic data in the past few years to show high growth when the real numbers were much lower".

Remarkably, that report was published by the China Daily, while the Global Times also printed those admissions of "bogus economic data". Both newspapers are controlled by the Chinese government.

"Throughout history, a lot of the provinces have been overstating their GDP and, at the national level, Beijing needs to readjust them," said Tommy Wu, lead economist at Oxford Economics in Hong Kong.

"Provincial GDP can even be bigger than national GDP at times."

One reason why local bureaucrats have been 'cooking the books' is that their promotions are linked with how well the economy is performing.

Even China's Premier Li Keqiang has problems trusting the official economic figures, according to a classified US document released by Wikileaks.

China's Premier Li Keqiang. Photo: Xinhua News Agency

Back in 2015, officials from China's Liaoning province dropped a bombshell.

According to the document:

"Mr Li reportedly told a US diplomat that 'GDP figures are 'man-made' and therefore unreliable'.

"All other figures, especially GDP statistics, are 'for reference only', he said smiling."

Li said the more reliable measures of economic activity were electricity consumption, volume of rail cargo and the amount of money lent out.

After his comments were leaked, sceptical economists (ironically) created the unofficial 'Li Keqiang index' - which tracks China's economy precisely according to the three metrics the Premier suggested.

However, its relevance has diminished in recent years as the Li index is better at tracking manufacturing activity -- rather than the booming services sector (which now makes up more than 50 per cent of the Chinese economy).

China's growth exaggerated?

For decades, Beijing has been setting ambitious economic growth targets, which it meets (or smashes) almost every year. The only time it didn't set a growth target was 2020, due to the massive unpredictability caused by the pandemic.

Some economists reckon China has inflated the size of its economy by more than 10 percent - by overstating its GDP by 1.7 percent each year, between 2008 and 2016. That's the key finding of a paper published by the Brookings Institution, a Washington think tank.

VOTE

Researchers at the Federal Reserve Bank also believe China's GDP data is "overstated", but for a more innocent reason. They said it's because the country's economic data system is still a "work in progress".

"The truth is more likely that economic growth in China is too challenging to capture as effectively as growth in developed countries."

But some say there's a more straightforward reason behind China's blockbuster economic surge.

"The Chinese Communist Part cannot rely on open and free elections for its legitimacy," Professor Laurenceson told ABC News.

"What it does rely on is delivering economic outcomes - that's the implicit contract the Chinese Communist Party has with the Chinese people.

"They're under a lot of pressure to deliver real outcomes, so when the economy has a hiccup you'll almost guaranteed to see the China government respond with stimulus."

Basically, China will do whatever it takes to meet its promise. Even if it means accumulating mountains of debt to invest in unproductive assets, like ghost cities (with millions of empty apartments) or "roads that go nowhere".

However, Professor Laurenceson stressed: "Just because there's a handful of ghost cities doesn't mean the rest of China's data is made up."

"The prosperity of China is real, along with its demand for goods from Australian farmers and miners, who aren't making up that demand."

"I don't doubt the degree of accuracy in general terms, but the figures within a 1-2 percent margin might be a little rubbery."

The conundrum is that there aren't many other ways to keep track of China's economic performance.

Covid-19, the latest miracle

Like most nations, China wasn't spared from the initial shock of lockdowns and factories being forced shut.

Its economy shrank by 6.8 percent in last year's March quarter - the worst result since the end of the Cultural Revolution in 1976.

READ MORE

- Chinese Communist Party spies infiltrating NZ universities, lecturers suspect

- New Zealand could be caught in Australia-China trade war - warns Foreign Minister

- New Zealand won't accept 'master-servant relationship' with China to derive economic benefits

- Australian journalist accused of pushing an agenda with controversial New Zealand-China relationship story

But unlike other countries, China managed to escape a technical recession, as its economy only contracted for one quarter (instead of two).

Within two quarters (by September), its GDP had rebounded to pre-Covid-19 levels.

Overall, when looking at 2020 as a whole, China's economy was an anomaly because it was the only one that experienced any growth (up 2.3 percent).

It performed a lot better than Australia's economy (which shrank 1.1 percent), and miles ahead of the United States (down 3.5 percent) and Britain (down 9.9 percent).

China's recovery looks even more impressive when you look at this year's March quarter. Its GDP surged by 18.3 percent (its highest quarterly year-on-year result ever), though the comparison is off a very low base.

What drove China's Covid-19 rebound?

The world's second largest economy received a major boost from its industrial sector, with factory output up 2.8 percent in 2020 (compared with the previous year).

China's exports also shot through the roof as the rest of the world, struggling with the coronavirus, ordered huge volumes of masks and stay-at-home equipment (like TVs, computers and sofas) from Chinese manufacturers.

Beijing's trade surplus surged to $US535 billion last year (up 27 percent from 2019), just shy of a record high.

It also helped that China cracked down on the virus early, with strict quarantines, rapid testing on a mass scale, and detailed contact tracing (using smartphone apps) - despite initially fumbling its response to Covid-19 by attempting to cover it up.

But there are signs of weakness in China's recovery. Retail sales dropped 3.9 percent last year, which doesn't exactly reflect booming consumer confidence.

"Domestic travel numbers have recovered to pre-pandemic levels," Wu said.

"Travel spending is still only about 75 percent of the pre-pandemic levels, so consumption is the weakness right now in China."

Will China overtake the US?

In November, China's President Xi Jinping laid out some grand ambitions for China.

Xi said it was "completely possible" that his country could double its GDP by 2035, according to China's state-run press agency Xinhua.

That suggests China is aiming to grow its economy to such an extent that it would dethrone the US as the world's biggest economy.

Many economists say China will leapfrog the US, but their point of difference is about the timeframe.

"By 2030, China will become the biggest economy in the world," Wu said.

The Hong Kong-based economist assumes China will expand at a "decent pace" over the next decade (about 5 percent GDP growth annually).

"China has a huge population, so multiply it with that GDP growth, and that could easily get you an economy larger than the US."

But even if the overall size of China's economy surpasses America's, that doesn't make it a wealthy country.

There's a stark contrast when you divide the overall pie (the size of the US and Chinese economies) by the size of their respective populations.

China's GDP per capita was $US10,262, while the United States was six times higher (at $US65,298), according to OECD figures. The World Bank classifies China as an upper-middle-income nation.

The standard of living is superior in wealthy cities like Beijing and Shanghai - much higher than the poorest regions like Guizhou and Xinjiang.

High debts and shrinking population

Like much of the world, debt could be a problem for China's ongoing economic stability. China has racked up $59.5 trillion ($US44.8t) worth of it, driven by its massive stimulus efforts.

It has been doling out cash to unprofitable state-owned companies since last decade's Global Financial Crisis and, more recently, the Covid-19 downturn.

The silver lining is that most of that debt is owed domestically, and that its foreign debt is just $3.2 trillion ($US2.4t).

"If the state's guarantee is removed, there's a much higher chance these local governments and corporations will default on their loans," Wu said.

"That will have a contagious effect on financial markets. But I'd say, knowing how the Chinese government operates, it will try to manage this in a more controlled manner."

China's rapidly ageing population could be another handbrake to its economic growth (which has been slowing in recent years). It's also the side-effect of the one-child policy it implemented for 35 years (from 1980).

So concerned was Beijing that it moved to a two-child policy in 2015 - then a three-child policy in June.

If current trends continue, China's population will peak at 1.44 billion in the next eight years, before it enters "unstoppable" decline (and actually shrinks), according to a study by the Chinese Academy of Social Sciences.

A baby boom is one thing that the government is hoping can prevent "negative population growth" (and a big fall in future tax revenue).

Professor Laurenceson is not expecting a flood of Chinese citizens to suddenly feel the need to reproduce.

"Chinese parents don't have lots of kids because of high housing costs," he said.

"The participation rate in Chinese women is low, so lifting that might help the economy. China could also raise retirement age, and invest in more automation.

"The Chinese government isn't without tools to address its demographic challenge, even if the three-child child policy won't do it."